Cloud banking delivers financial services over the Internet using cloud computing resources (virtual servers/data centers). It streamlines customer transactions, thereby making services such as online and app-based payments more convenient.

Cloud banking lowers operational expenses of financial institutions, brings data security to life, and incorporates AI and machine learning technologies. Instead of using cloud infrastructure to improve banking operations, this evolution enables remote service delivery to help improve the task flow in banks.

Read more about the differences between public, private, and hybrid clouds with examples of when they are employed.

What is a Private Cloud?

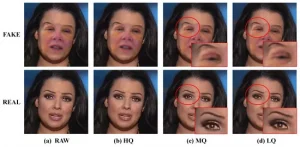

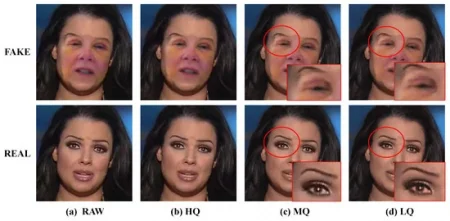

As banks first began looking towards the cloud, most used a private cloud approach since it was perceived as more secure. A private cloud refers to a cloud computing environment built for a single organization. Since a financial institution is using services on its private cloud, delivered through its network, it makes one believe no bad actors can get into it and access customer data.

The infrastructure for private cloud instances is typically housed in a financial institution or a third-party vendor data center, which provides an extra layer of security. While the private cloud is appealing for its security and control, it lacks the elasticity that public clouds can offer to reduce costs and facilitate speed to market. Banks have now started viewing the public cloud more favourably given the significant advances over what had been available 5 years ago.

What is a public cloud?

The public cloud offers the standard model to customers and can be accessed through the Internet. Public cloud instances are widely hosted by some of the largest corporations in the world. The public cloud allows banks to keep customer data in one place and scale their services up or down as per the need.

The public cloud model, while it provides massive cost advantages over traditional on-premises data centers, is also increasingly the source of concern amongst some financial institutions. There is a conflict with data privacy laws, as many of these servers where data is stored are physically located in different countries.

Multicloud and hybrid cloud environments

Hybrid cloud and multicloud solutions are defined as a mix of public clouds, private clouds, or an on-premises data center comprising a common technology. In simple terms, these are a blend between public and private cloud-hybrid cloud environments.

The term multicloud refers to the use of multiple public clouds as well as both private and public cloud resources. More and more banking deployments are taking a hybrid or multicloud path, meaning banks shop among providers to obtain the best price for cloud service.

Examples of cloud banking

Use cases continue to grow as financial institutions look at how they capitalize on the cloud and what it enables them to do. This means both small and large institutions are beginning with other new digital transformation programs that have their cloud migration as a key component.

Here are some ways in which cloud banking is transforming the face of financial services:

Legacy Systems Replacement

Older IT systems pose a plethora of challenges in the banking industry as the cost to update their infrastructure is high. Maintaining it is also expensive, not to forget the costs associated with the lost opportunities in a world where the speed and agility of new technologies are of paramount importance.

Cloud capabilities are increasingly becoming a part of the broader modernisation story; banks are migrating to data storage and moving from older, more expensive IT infrastructure to newer cloud models that tend to be leaner. This results in cost savings, and banks are taking their technology offerings to new customers

Increase in FinTechs and challenger banks

Cloud banking has rocked the banking world to such an extent that some challenger banks do not have a single brick-and-mortar branch. Indeed, challenger banks—tech firms that make extensive use of financial technology (fintech) solutions to provide wholly digital banking services—are using the cloud to develop all-digital banks. However, others work strictly through an app you download to your phone.

Challenger banks deliver traditional financial services—such as checking/savings accounts, loans, and credit cards—using the cloud but with virtually no overhead for branch locations or all of the people required to run them (according to a report from Accenture wherein these would be considered “legacy costs”).

Emergence of open banking

Open banking (or open bank data) is a practice in which banks provide access to financial information through the use of cloud technologies. New services and products will be able to deliver new payment models.

Banks that do open banking must ask their customers to share information (a so-called consent form). Their account data and other information, including transaction history, can then be accessed through an application programming interface (API). The use of open banking here is broad—which, in many cases, means opportunities for loan providers, etc., to market services and the development of new platforms.

Leveraging Off-the-Shelf Capabilities

As a lot of financial institutions transitioned from private to public cloud, new offerings are constantly being planned, designed, and commoditised via the “as-a-service” model. This will now allow banks to test various services or products with their customers.

It also assists banks to move away from competing with fintech—which is seldom in the core banking competency wheelhouse—but still leverages innovations happening around them.

In case you missed:

- Cloud Banking

- What is Data Sovereignty?

- A Comprehensive Guide to Understanding Hyperscaler Technology

- Sustainability Shift: Evaluating the EV vs Hybrid Debate

- Hybrid Revolution: Navigating India’s Path to Greener Mobility

- 10 Well-Known Social Media Sites That Were Closed, From Omegle to Orkut

- Preventive Medicine in the Digital Age

- The Role of AI in Driving Digital Transformation

- The Symbiosis of Medicine and Machines: Pioneering Technological Transformations in Healthcare

- Sonic the Hedgehog – The Ultra-Fast forward