Uma Iyer explains RegTech, its existence and its potential uses for business interests

Financial Regulators have been traditionally viewed as archaic old school beings who live in a 1950s space working with ink pens and paper. The view is changing fast, thanks to FinTechs working on innovative systems helping the regulatory space become the next big thing.

Deloitte says, RegTech is the new FinTech. If Technology is going beyond simplifying banking systems, it is now expanding to ensuring that regulations and regulatory systems catch up at pace.

Regulatory Technology (RegTech) is an innovation that enables firms to seamlessly adopt the ever-expanding view of regulatory reporting. While at the same time being resilient, nimble, and secure. Financial services and allied organizations can in turn automate the way they monitor and effortlessly navigate through information while still being aligned with regulatory perquisites.

Business Potential

Simply put, new regulation equals new opportunity for RegTech to work on a new product or offering to financial services companies.

There is a lot of potential for streamlined technology for regulatory activities. This particularly has come in helpful during the COVID-19 crisis. It is a pivotal moment in the RegTech area to take a leap forward during this event in recent history.

The advent of modern times has posed significant regulatory challenges and rules updates. There were more than 1,300 changes in March of 2020 itself.

Due to how banks and financial services companies operate, transformation has been paramount. With transformation has come a host of cyber risks, forcing regulatory bodies to examine and set a future for the technology they support.

While FinTech has collaborated with RegTech, now there is even more focus on closing the gap between compliance and regulation while being relevant. SupTech capabilities are being built by financial regulators for use by all financial services companies.

RegTech companies you should know

- Chainalysis

- ComplyAdvantage

- Ascent Regtech

- Forter

- Hummingbird

- Continuity

- Trunomi

- Ayasdi

- Sift Science

- Elliptic

- BehavioSec

Strength in numbers

What is SupTech?

“Supervisory Technology (SupTech) is the use of innovative technology by supervisory agencies to. support supervision. It helps supervisory agencies to digitize reporting and regulatory processes, resulting in more efficient and proactive monitoring of risk and compliance at financial institutions.”

Every bank has supervisors and runs on ‘Lines of defense.’ The more the supervision there is a need for a technology to support it. This is where SupTech is key. “The Bank for International Settlements (BIS) defines SupTech as the use of innovative technology by supervisory agencies to support supervision” Supervisory agencies lay down the rules and regulations which are then built to specifications and serviced by the SupTechs.

“In 2017, the SEBI set up a committee to evaluate opportunities enabled by technology and deal with relevant risk. The SEBI also proposed a Sandbox environment to supply a safe space for companies to test innovative technologies.”

SupTech – Using tech to solve supervisory challenges – PwC India

RBI also is keen on using SupTech. At the Fintech conference in RBI on March 25th, 2022, it was considered that RegTech and Suptech play an especially key role in mitigating potential risks. Supervisors having to undertake accelerated offsite surveillance, SupTechs prove extremely helpful. They also bring out transparency to the data that the banks hold.

Variants

There are many more variants springing up in the FinTech space namely:

BankingTech – Specially created for Banking technologies, it relies heavily on Machine learning and Artificial intelligence.

WealthTech – Investment space in Americas after the Wall Street debacle have a very acute interest with regulators. The new ways of investing in compliance also while creating new ways of investing money in Cryptocurrencies, etc., is a growing field.

InsureTech – the current insurance providers are regulated; however, the technological developments help create a transparent system.

What is next?

Sustainability and Environmental Social and Corporate governance, now, uses RegTechs reporting to improve the initiatives. The reporting usage is limitless and helps financial services companies follow efficiency and effectiveness.

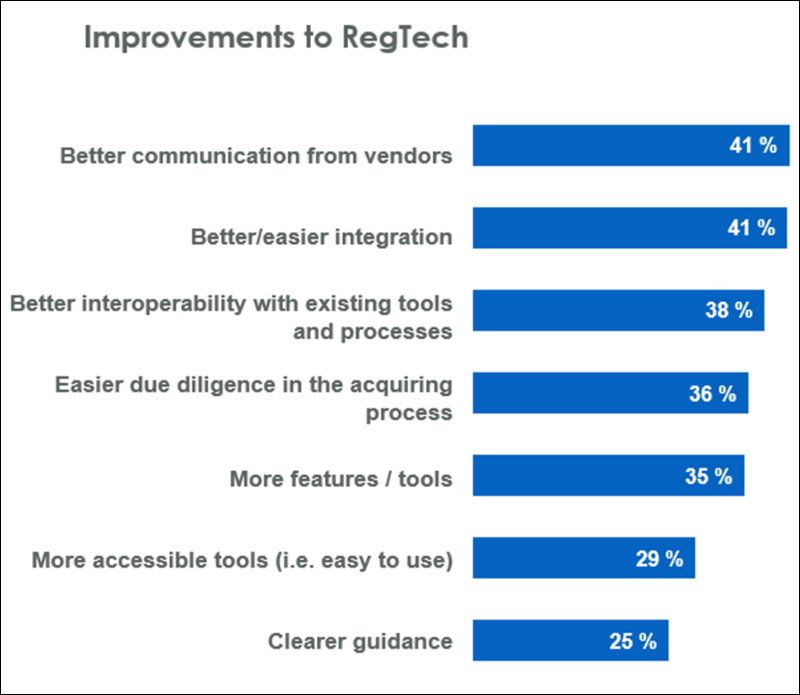

There is an increasing need for transparency and common language, which RegTech will continue to break barriers in and grow. Different countries have different regulations and definitive taxonomy to being commonality in transactions will be hugely beneficial to avoid Anti Money Laundering and prevent Fraud.

The innovative mechanisms have weathered the COVID-19 phase however, the learnings can be employed to ensure that future financial view is secured and have a mutually supportive ecosystem. Given the technology is at its nascent stage the possibilities are endless and ever growing.

In case you missed:

- None Found