Blockchain projects have received their fair share of rap thanks to the energy consumption. But this may change with the usage of power-saving mechanisms.

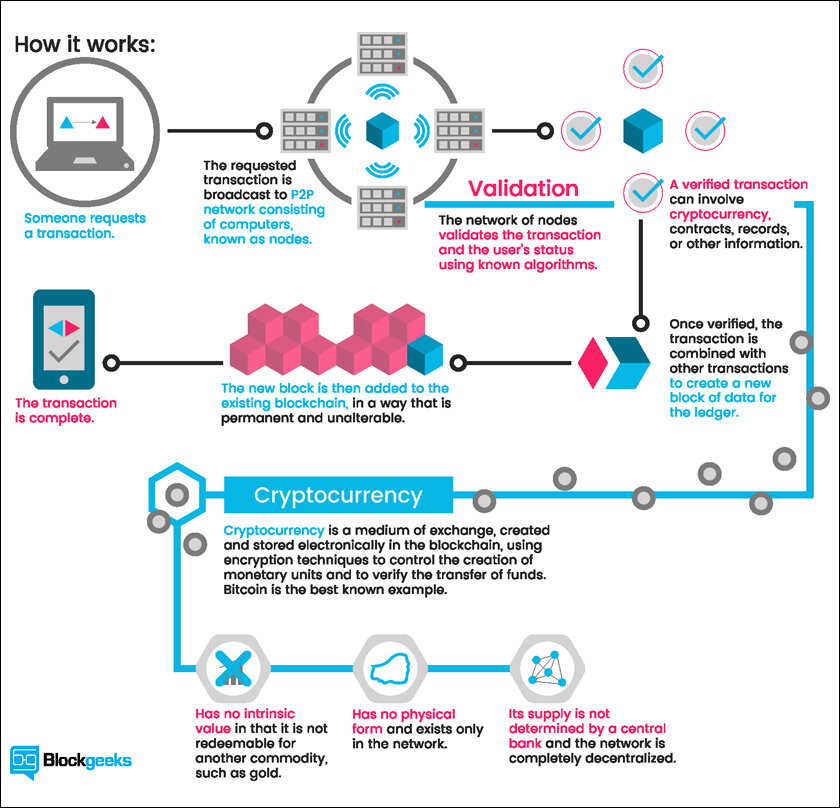

Consensus mechanisms are the lifeline that make or break a blockchain network. Remember Blockchain? That venerable keyword that had the industry dissected some years ago? A consensus mechanism is an algorithm that helps reach a conclusion within a group of related parties. Such an algorithm is the lifeline of any decentralised network.

The practicality and efficiency of blockchain projects relies enormously upon the utilisation of a consensus mechanism. Blockchain, the alternate universe which powered popular cryptocurrencies such as Bitcoins and Ethers, was frowned upon for a long time over its excessive power-consumption.

In fact, in April last year, a Sify writer analysed its energy-efficiency, labelling blockchain as a factor for planet earth’s higher than usual carbon footprint. A salient feature of that analysis was the energy utilisation of Bitcoin alone – towering over the consumption of countries such as Bangladesh and nearly that of Chile and Belgium.

In an era where carbon emissions remain as observed as the tape around one’s waist, is Blockchain and its inhabitants such as Bitcoin taking up any concrete steps? A graph shows a somewhat hazy picture representative of the scenario. Compared to last year, Bitcoin energy consumption seems to have rationalised. Now this could also be ascribed to regulatory crackdowns imposed in countries like China on the bitcoin mining process. More importantly, the increase in mining-complexity may have resulted in moderation.

Find more statistics at Statista

Ethereum, the second most voluminous crypto avenue out there has managed to sustain itself with a consumption of 0.0026 Twh/yr. That is nearly 10,000 times more energy-efficient than Bitcoin. Why and how?

Proofing concepts involve how miners solve complex problems to get to a block and from there the ability to win either a bitcoin or an Ether. With bitcoins, miners show a proof of work and the accompanying correspondence between the network and its intermediaries is one reason where it guzzles more power. In the world of Ethers, this problem is restricted thanks to the concept of stake-coins where those with confidence and better probability stake their claim to solve a problem.

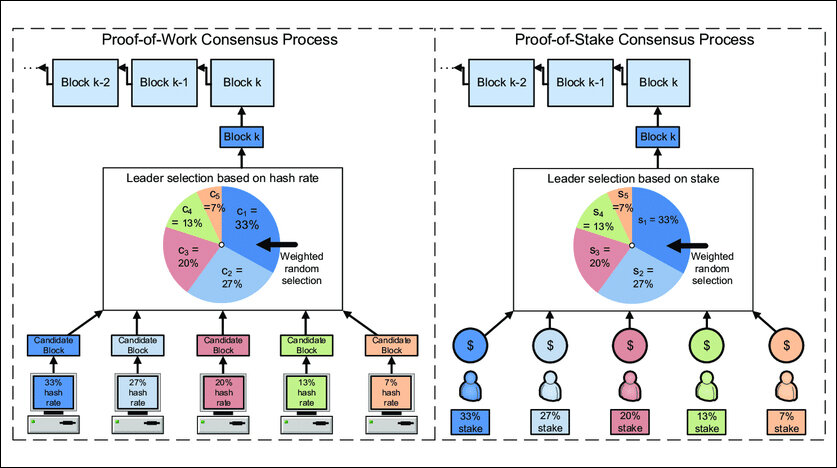

Although “Proof of Work” and “Proof of Stake” are both ways to ensure a fair game, they are as different as chalk and cheese when it comes to power consumption. To the curious, both are consensus mechanisms or in simple words a method for the blockchain to maintain agreement between all parties.

In the PoW consensus mechanism, miners compete to solve complex mathematical puzzles to add blocks to the blockchain. This process requires significant computational power and energy consumption, as miners continuously run powerful hardware to find the winning solution.

On the other hand, the PoS consensus mechanism doesn’t require miners to solve computationally intensive puzzles. Instead, validators are chosen to create new blocks based on the number of coins (or stake) they hold and are willing to “stake” as collateral. Validators are incentivized to act honestly, as they can lose their stacked coins if they behave maliciously. Since PoS doesn’t rely on energy-intensive computations, it is considered much more energy-efficient compared to PoW.

Another variant of PoS is Delegated Proof of Stake (DPoS), where stakeholders vote for a limited number of delegates to produce blocks on their behalf. DPoS can be even more energy-efficient than traditional PoS, as it reduces the number of direct validators to a small group of trusted entities.

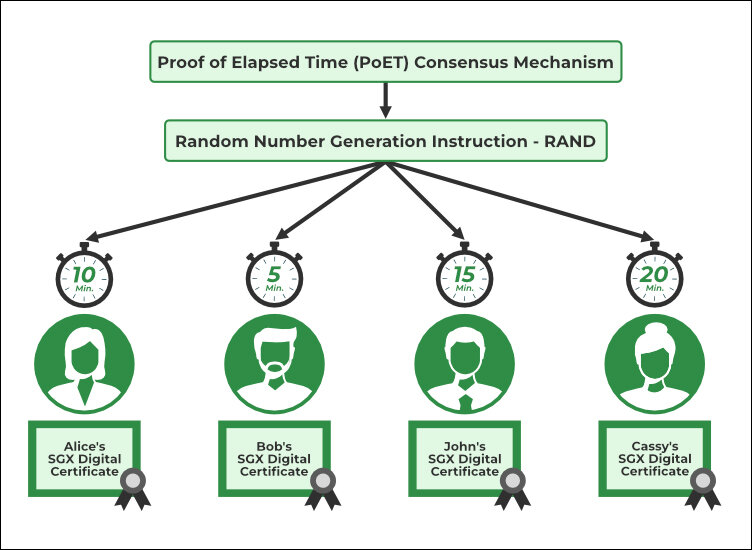

PoET MECHANISM

Intel’s development on the PoET mechanism is an alternative to those blockchain networks wanting to pare down power-consumption. A simple understanding of a PoET mechanism would be a group discussion where individual participants are allocated specific time by a moderator to speak (solve a puzzle or answer a solution in the case of Blockchain). The network manages to save resources by allowing nodes (participants) to achieve a stage of hibernation.

PoET networks are generally implemented within trustworthy scenarios environments operated by an automated system within a Trusted Execution Environment (TEE). What makes them viable is their ability to be integrated in cohesion with PoS systems. Supply-chain and enforceable smart contracts usually automate processes by codifying outcomes within the TEE.

ABILITY TO SCALE

Scaling a consensus mechanism algorithm is crucial for the successful operation of blockchain and distributed ledger technologies. As the number of participants and transactions increases, the consensus algorithm must efficiently handle the growing workload while maintaining security and decentralisation.

There are multiple ways to achieve efficiency from scale. Largely, parallelization is used to distribute computational load across multiple nodes. In the case of the FileCoin which rewards users for sharing storage resources, relies on two consensus mechanisms – Proof of replication and spacetime. This crypto service resorts to parallelization. Another trick blockchain systems have used are off-chain scaling processing to move non-critical processes to a separate chain. This reduces the workload on the main consensus algorithm. Techniques like state channels and side chains can be used to handle transactions that don’t require immediate settlement on the main blockchain.

Different consensus mechanisms such as PoW, PoS, Delegated Proof of Stake, etc. have unique characteristics and challenges with scaling. The energy efficiency of a consensus mechanism also depends on other factors, such as the number of nodes, the network’s design, and the specific implementation of the protocol. Additionally, blockchain projects may use hybrid consensus mechanisms or innovative variations that aim to balance security, decentralisation, and energy consumption. But the interest level for a viable consensus mechanism has risen post the announcement from regulators and private players on blockchain based Central Bank Digital Currencies (CBDCs) and payment gateways.

In case you missed:

- None Found

1 Comment

I reed your information great it’s perfect.