Fintech has not only entered the mainstream but is trying to increase profitability and play a real-life game of ‘Risk’ without flipping the table.

The BFSI sector has been on a growth spree, performing acrobatics over the last two decades and turning India from a cash lover into a digital enthusiast. When fintech strutted onto the scene in early 2009, it faced more skepticism than a pizza delivery guy promising a 10-minute delivery during rush hour. People wondered if it would take off in India – a country that still argues about the correct pronunciation of ‘gif.’

Fast forward to today, fintech has not only entered the mainstream but is confidently strolling through its middle-aged phase, trying to increase profitability and play a real-life game of ‘Risk’ without flipping the table.

Fintech’s ascent in India, akin to other digital wonders like e-commerce, owes much to the widespread adoption of smartphones and the delightful drop in data prices. If fintech were a superhero, its cape would be woven from the fabric of increased internet penetration. With a whopping 750 million active internet users today, and an anticipated leap to 900 million by 2025, as per an IAMAI report, it is safe to say that fintech is riding the digital wave with the confidence of a surfer on a high-tech board.

As India eagerly sprints towards the coveted $5-trillion economy status, fintech companies are gearing up to be the MVPs of this economic spectacle. Brace yourself for a wild ride, as these financial wizards plan to conjure up over $400 billion worth of businesses in the next seven years – that is a fourfold growth spurt that even caffeine cannot match. Not stopping there, they aim to dip their fingers into a revenue pool, snatching a cool $70 billion out of the grand $620 billion by the time 2030 rolls around. Move over, economic milestones – fintech is here to add a touch of magic to the fiscal jamboree!

Adding to the fintech frenzy, the diverse consumer demographics in India are set to kickstart the adoption and rampant growth of digital financial services. According to the Pew Research Centre, a whopping 40% of India’s population is currently under the age of 25, setting the stage for a youthful financial revolution.

Brace yourselves for the entrance of Generation Z into the job market, boldly navigating their investments through the digital avenues – because in their world, wallets are so last season, and smartphones are the new stock exchanges. Get ready for the financial glow-up, brought to you by the tech-savvy youth brigade!

Thanks to the magic of generative AI, get ready for a future where personalized solutions are served up on a silver platter, considering user context and history. But wait, there is more – buckle up for conversational interfaces that can chat with you in a variety of regional languages. It is not just an evolution; it is a tech-driven revolution, making interactions livelier and more accessible across the country. Say goodbye to the digital and financial divide; we are all aboard the express train to a more interactive and inclusive future!

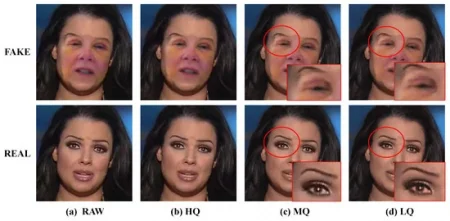

Hold on to your hats – voice-activated tech is stepping up to the plate to tackle fraud in KYC scenarios. But, and there is always a but, the plot thickens. The super-accurate voice detection brought to you by generative AI is in a bit of a showdown with the mischief-makers in the deepfake realm. It is a high-tech game of cat and mouse. Fintech whizzes and regulatory superheroes need to be nimble, ready to dodge the curveballs of negative use cases, all while championing the responsible use of AI. It is a thrilling saga of tech, fraud, and the quest for responsible innovation!

Behind the scenes, cue the entrance of generative AI, taking center stage for a more precise credit risk assessment and a seamless customer onboarding experience. But that is not all – for users, get ready for personalized algorithms sculpted to fit like a glove, considering your historical data and behavior.

Imagine having a digital financial assistant at your disposal, offering tailored advice for saving and investing. It is not just enhanced accessibility; it’s a VIP pass to a smarter, more intuitive financial journey for everyone. Say hello to financial assistance in the digital age – where every bit is brilliantly tailored to fit your financial puzzle!

While we are backstage, let us give a round of applause to the country’s nimble regulatory framework, the unsung hero fostering innovation. With the agility of a superhero, it swiftly responds to every twist and turn in the fintech tale. The RBI deserves a special mention, actively nurturing the growth of the fintech sector with superhero-level regulations like card tokenization and digital lending guidelines, all in the name of protecting consumer interests. These measures are not just rules; they are the architects building a sustainable business utopia, where fintech players bridge the digital divide and champion top-tier financial inclusion. Kudos to the regulatory maestros orchestrating this fintech symphony!

Cue the G20’s policy recommendations, spotlighting the promotion of Digital Public Infrastructure (DPI), emphasizing the power of safe, transparent, and interoperable payment systems in uplifting millions of small merchants. Fintech wizards are waving their wands, leveraging this interoperability magic to conjure up even more user-centric financial solutions in the coming year. And the plot thickens – other developing nations are eyeing India’s DPI, with a particular fascination for the Unified Payments Interface (UPI). Brace yourselves for the UPI spectacle, set to not only steer the growth of digital payments in India but also make waves in other global markets. It is a fintech revolution with a sprinkle of international stardom!

Hold on tight as the fintech rollercoaster keeps on rolling, with business models doing the cha-cha of evolution and pivoting. In this ever-shifting landscape, the industry is in constant flux, demanding regulators to dance alongside technological beats. As financial services boogie their way into the online realm, concerns arise about user data doing the jitterbug of fragmentation and murkiness. Enter the RBI, proposing a centralized data storage platform – a giant leap in India’s digital dance of financial services, fueled by the massive user craze for digital payments. It is not just a platform; it is a secure, centralized vault, ensuring a tango of stringent compliance to fortify the fort of data security and privacy. Get ready to dance into the secure and private future of fintech!

The RBI is dropping hints like breadcrumbs, suggesting a shift towards tailored SROs (Self-Regulatory Organizations) in the next year. These SROs are set to play referee across various fintech domains, from payments to digital lending. It is not just a move; it is a nod to the diverse needs within the fintech family, a strategic play to ramp up compliance and deftly navigate the twists and turns of regulatory challenges. Get ready for a regulatory makeover, custom-fitted for the intricate dance of the fintech world – because sometimes, one size does not fit all!

Navigating the fintech terrain in India, much like other digital frontiers, will encounter hurdles in the form of cyber risks and data security concerns, especially as we venture further into the AI-led future. But fear not, for these challenges are not roadblocks; they are catalysts for a grand collaboration and innovation waltz between FinTech maestros and their traditional banking counterparts. Together, they will choreograph agile and proactive regulatory responses, orchestrating a ballet of innovation that not only propels progress but also stands as a formidable guardian for users.

The stage is set for a dynamic, innovation-fueled future in India’s fintech realm, where the dance of technological evolution harmonizes seamlessly with the twin pillars of user protection and empowerment. Get ready for the grand finale of a fintech revolution with a touch of innovation magic!