Dinesh Elumalai explains what robotic process automation is, and how it is revolutionizing the business sector

Accounting is the key to any business, and technology looms large over this feature of corporate life as well. Success in today’s fiercely competitive industry depends on automation. One of the most game-changing developments in the industry is robotic process automation (RPA).

At 53% adoption rate in 2018, RPA is now a necessity for enterprise-scale businesses rather than just a fancy term. And according to Deloitte, by 2024, all significant corporations will have begun their RPA journey.

Less than one-third of RPA adopters use the technology for accounting and financial reporting, despite the technology being widely used. RPA is being adopted by creative managers to automate accounting procedures and improve business operations.

However, what is RPA? And how do you automate accounting using it?

What is RPA?

RPA is a type of software that automates processes while enhancing human workers. Accountants today use tools and procedures that are computer-based but require several keystrokes and manual steps. RPA can transform accounting processing by combining multiple manual tasks into a single simple automated procedure. The automation of robotic processes is summarized here:

- When completing accounting activities, the RPA bot first records user on-screen actions such as clicks and entries.

- Second, the program develops a screenplay based on how users navigate across the screen.

- Third, the RPA bot automates repetitive, rule-based accounting processes using produced scripts.

RPA bots mimic human actions to complete a task within a process. These computer programs can perform repetitive tasks quickly, precisely, and consistently. RPA offers accountants a special chance to streamline their accounting procedures.

Benefits and Challenges of RPA in Finance and Accounting

It is the same as for any other industry: it is the digital automation of laborious, high-volume, and repetitive work.

RPA integration is only practical when: there are significant potential time and financial savings, regardless of the process, department, or business. Because of this, it is essential to do some math and assess the RoI (return on investment) before you get started.

Initial operations have a high level of quality, and procedures follow standardized, rule-based procedures. Otherwise, automating disorder will only result in more automatized chaos.

Both requirements are met by finance, which has departments for accounting and buying. It is well known in business for time-consuming, repetitive operations like data entry, reporting, cross-checking, and record keeping, which are ideal for RPA bots. On the other hand, because there are so few exceptions or instances of human decision-making, most procedures are structured, and rule based.

The wonderful thing about robotic process automation is that, once deployed, you will at once witness a return on investment. It appears to be low-hanging fruit given the comparatively simple setup and the fact that robots do not physically interface with your information systems.

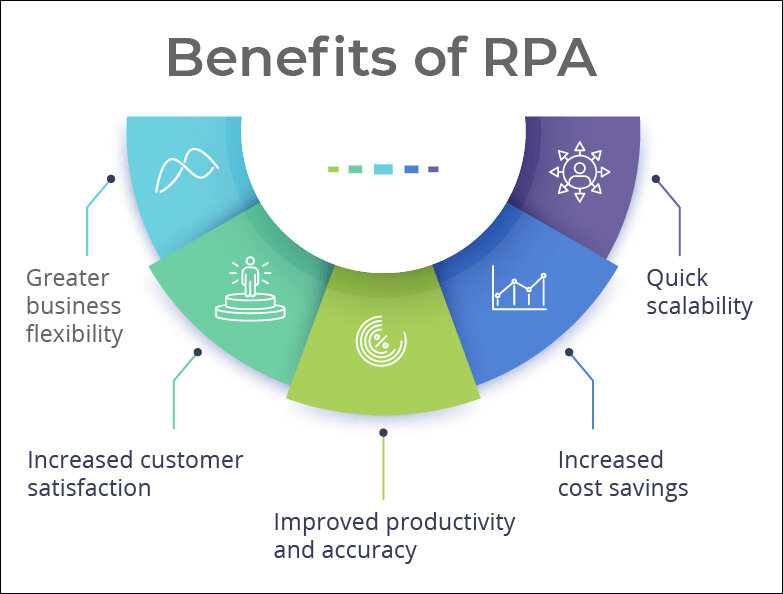

Most people equate automation with availability and 24/7 dependability, which is true of RPA. For accounting automation, RPA bots do not need sick days. They give consistent and accurate service of the highest caliber. The following are some advantages of using RPA for accounting automation in large-scale enterprises:

- Cost Cutting

- Productivity Boost-up

- Error Reduction

- Efficient use of Time

- Subject to Compliance

- Happy Customers

- Data Centralization

What are RPA’s Accounting Use Cases?

Most large-scale businesses must process hundreds or thousands of transactional records each month. Accounting teams must search through various information systems for documents, scan them, analyze the digital versions, extract data, and finish data entry. RPA can help to automate this procedure and get rid of human mistakes. The top RPA use cases in accounting are listed below.

- Accounts Payable

- Accounts Receivable

- Intercompany Reconciliations

- Travel & Expenses

- Payroll

- Financial Reporting, Planning and Forecasting

Accounts Payable

Processing invoices need prompt action, accuracy, and consistency. However, without automation, it is easier said than done to reach this degree of perfection. For one thing, manually processing invoices might cause delays in accounts payable operations. Including receiving, validating, and paying invoices, RPA can automate the processing of invoicing. RPA using optical character recognition (OCR) gathers data from various sources, compares invoices and purchase orders, and flags documents that do not match. They will then set up reminders and send approved bills to the designated team members for approval. Automate accounts payable procedures with RPA to increase Days Payable Outstanding (DPO). Vendor verification, purchase order submission, payment reconciliation, and expense compliance audit can all be streamlined by your bot.

Here are some instances of what RPA may accomplish:

1. Vendor verification and set-up

2. Purchase order entry

3. Extracting data from invoices and purchase orders

4. Vendor invoice processing

5. Cross-checking invoices with purchase orders

6. Preparing and/or performing payments

7. Payment validation and reconciliation

8. Expense compliance audit

9. Monitoring duplicates

10. Responding to vendor inquiries

Accounts Receivable

This accounting procedure relies on internal documentation, is prone to inaccuracy, and would benefit from automation. To increase Days Sales Outstanding, execution must be precise and timely (DSO). However, because of the human factor on both the payee’s and recipient’s sides, attaining this is difficult. Accounts Receivable tasks such as customer data creation and management, data extraction, sales quote, and invoice generation and delivery can be automated using RPA. Feature-rich RPA systems help enhance cash flow and close financial deficits. RPA automates data entry automatically and gathers information from many sources. So, there will not be a need for multiple information systems for accountants.

Here are some instances of what RPA may accomplish in accounts receivable:

1. Customer data setup and management

2. Extracting customer information from different sources

3. Sales quotation and entry generation

4. Invoice generation and distribution

5. Cash application

6. Customer credit monitoring

7. Dispute resolution

8. Follow-ups, reminders, and dunning

9. Credit risk management

10. Chargeback

Intercompany Reconciliations (ICR)

By automating ICR and balancing accounts, RPA can produce accurate financial statements. Time-consuming data entry, extraction, and cross-checking are all part of this procedure. RPA bots can collect transactional data, validate documents that match, and highlight inconsistencies. They can generate diary entries, cross-check statements, email clients, and retrieve data more quickly.

You can automate and streamline the following processes by implementing RPA:

1. Extracting or retrieving data from files

2. Searching for related statements in ERP (Enterprise Resource Planning) systems

3. Comparing balances

4. Looking for missing invoices and sending emails to customers

5. Reporting discrepancies

6. Directing reports to the business controller

7. Creating journal entries

Travel & Expenses

RPA bots can help travelers and accountants with a lot of tedious work when it comes to business travels, improving the employee experience. With no effort on the part of the personnel concerned, they can read and extract data from all kinds of receipts, determine if they qualify as business expenses, and compile the information into precise expense reports.

1. Entering expense records and checking according to company policies and legislation

2. Aggregating data into expense reports

3. Creating paychecks and managing benefits and reimbursements

4. Alerting in case of policy violations or data discrepancies

Payroll

Speaking of payroll, by handling data entry, timesheet validation, and deduction computations, bots help to avoid payment delays and mistakes. Even paper sick lists, which are still used in some countries, can have data extracted from them.

These are the applications that RPA can be used for.:.

1. Employee data extraction

2. Data verification across information systems (sick days, business trips, timesheets)

3. Generating and approving timesheets

Financial Reporting, Planning, and Forecasting

By precisely and regularly tracking and reporting profits and losses, successful businesses can keep an eye on their financial performance. You are an accounting expert; therefore, you are aware of the difficulties of manually updating P&L reports. RPA can be used to automate this laborious procedure and offer precise real-time financial reporting. RPA bots may automate operations like variance analysis and financial closing as well as produce balance sheets and income statements. By making use of historical data and pertinent information from papers, they can also enhance financial planning and forecasting. This business process might be automated with RPA to increase accuracy and transparency.

There are quite a lot of reporting processes where RPA can come handy:

1. Trial balance and balance sheets

2. Income statements

3. P&L

4. Variance analysis

5. Financial close processes

6. Regulatory/management reports

Conclusion

By precisely and regularly tracking and reporting profits and losses, successful businesses can keep an eye on their financial performance. You are an accounting expert therefore, you are aware of the difficulties of manually updating P&L reports. RPA can be used to automate this laborious procedure and offer precise real-time financial reporting. RPA bots may automate operations like variance analysis and financial closing as well as produce balance sheets and income statements. By making use of historical data and pertinent information from papers, they can also enhance financial planning and forecasting. This business process might be automated with RPA to increase accuracy and transparency.

In case you missed:

- None Found

3 Comments

Nice one.

Nice article very interesting

The “Meet the Auto Accountant” piece on Sify Digital Transformation provides an overview of automated accounting systems and their significance in the financial sector. Artificial intelligence and machine learning, among other technological developments, are discussed by the author as having the potential to drastically alter the way accounting is traditionally done. Advantages of automation, such as increased precision, are discussed in this the piece.