Before you invest money that you earned the hard way, it’s crucial to understand the dirty tricks shady developers and bad actors use to manipulate markets and drain bank accounts.

The world of crypto can feel a lot like a gold rush, exciting, full of potential, and just as likely to leave you empty-handed if you don’t know what you’re doing. While Bitcoin and Ethereum have turned early believers into millionaires, the crypto space is also littered with scams, rug pulls, and hype-driven disasters. While new investors often dive in chasing quick gains, they often find themselves caught in a pump-and-dump scheme or simply holding worthless tokens.

Meme coins, celebrity-endorsed tokens, and projects promising revolutionary tech often aren’t what they seem. So before you invest money you have earned the hard way, it’s crucial to understand the dirty tricks shady developers and bad actors use to drain wallets and manipulate markets.

Rug Pulls, Pump-and-Dumps, and the Art of Vanishing with Your Money

Now while Crypto does undoubtedly offer real opportunities, it also has a track record of rewarding the informed and punishing the reckless. Let’s start with the biggest and most common crypto scam of all, the rug pull. The concept is actually quite simple, a project launches with big promises, flashy marketing, and just enough buzz to attract early investors.

The token skyrockets in value, more people pile in, and then the developers drain the liquidity pool and vanish. The price crashes to zero, and investors are left holding tokens that can’t be sold. Squid Game Token (SQUID) was one of the most infamous examples, riding Netflix’s Squid Game hype all the way to a 23,000% price spike, only for its creators to disappear overnight, taking millions in investor funds with them.

Another classic scam tactic is the pump-and-dump. This usually involves insiders or “whales” who secretly hold a large supply of tokens and manipulate prices through coordinated buying and social media hype. Believing they’re getting in early on the next big token, many new investors fall for the hype, further inflating the price.

When the prices reach their peak value, the whales then dump their holdings (making a fortune), and create a tsunami of supply, crash the demand, and leave small investors with massive losses. It’s also important to acknowledge that every crypto scam isn’t going to be as in-your-face like the rug-pull or the pump-and-dump.

There are stealthier ways in the crypto world to exploit investors too.

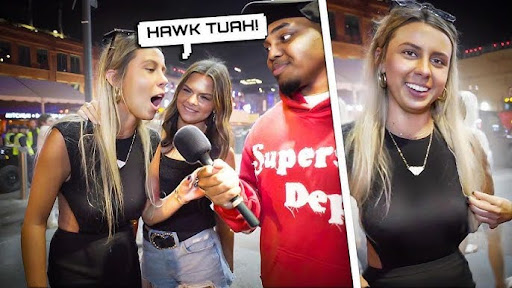

Meme Coins, Hype Trains, and the Hawk Tuah Effect

Some coins can even come with hidden restrictions in their smart contracts that prevent selling in order to insure only insiders can cash out. Others rely on wash trading, where bots create fake trading volume to make a token seem more active and desirable than it really is. Then there’s the “influencer-backed” scam, where celebrities, influencers, or even YouTubers promote a coin, dump their holdings once followers buy in, and walk away with huge profits, leaving their fans broke.

Meme coins are the wild west of crypto, some go on to build real communities (like Dogecoin or Shiba Inu), but most are cash grabs riding viral moments. A perfect example? The Hawk Tuah token. Inspired by an internet clip, this coin went from zero to a $500 million market cap in days before it collapsed over 90% just as fast.

Investors obviously rushed in, hoping to ride the hype, only to realize that the people behind it were the only real winners. This cycle happens over and over. Floki Inu, Dogelon Mars, Pitbull Coin, all meme tokens that soared and crashed, leaving most investors in the red. Some developers keep launching new tokens, each time with a fresh meme and fresh promises, but the same inevitable result.

These projects rely on FOMO (fear of missing out), influencer marketing, and short-term hype, but they don’t last. If a coin is only going up because TikTok, Twitter, or Reddit is hyping it, chances are it’s a ticking time bomb. Even projects like SafeMoon that everyone thought was legit ended up being an exit scam.

Always Do Your Homework

In conclusion, if all a project is worth is its initial hype, it’s smarter to stay away and swallow that fear of missing out on the next Bitcoin. While Crypto does have real opportunities, without research it can be a lot like playing the lottery, if the lottery was rigged by the people who own it. The biggest mistakes newcomers make is falling for hype, ignoring red flags, and investing in projects they don’t fully understand.

If a coin is skyrocketing overnight, you need to understand why and if you can’t find a logical reason, it’s quite possible that the value is being manipulated. If a project promises guaranteed returns, passive income, or promises to be “the next Bitcoin,” assume it’s a scam until proven otherwise.

In case you missed:

- PVC Meta Coins: The Next Big Thing in Crypto?

- Pi Coin vs Bitcoin: Round 2, Mainnet Launch

- Will Pi Coin Be the Next Bitcoin? A quick Reality Check!

- Samsung’s new Android XR Headset all set to crush Apple’s Vision Pro

- CES 2025: NVIDIA’s Cosmos Just Gave Robots a ‘ChatGPT Moment’!

- DeepSeek’s AI Revolution: Creating an Entire AI Ecosystem

- X’s Trend Genius: Social Media Psychic or Just Another Algorithm?

- Netflix replaces its game developers with AI

- NVIDIA just dropped “ACE” at CES 2025: Truly intelligent NPCs coming soon!

- AI in 2025: The Year Machines Got a Little Too Smart (But Not Smart Enough)