Awide variety of industries utilize blockchain technology to boost their bottom line, but it still seems to have avoided the ‘Tulip mania’, Uma explains.

In the 17th century the price of tulip bulbs skyrocketed. As the price of tulip bulbs increased, more and more people bought them, hoping to make a profit. However, the price of tulip bulbs eventually collapsed, and many people lost a lot of money. This had a significant impact on the Dutch economy, as many people had invested heavily in tulip bulbs. The period was called Tulip Mania.

Every generation has its own craze. Cryptocurrencies and its cousins have been talked about as the next rush. Cryptocurrency never became a Liberty Dollar – a private currency system started in 1998 by Bernard von NotHaus, also co-founder of the Royal Hawaiian Mint Company and creator of the Free Marijuana Church of Honolulu.

Can you and I create cryptocurrency?

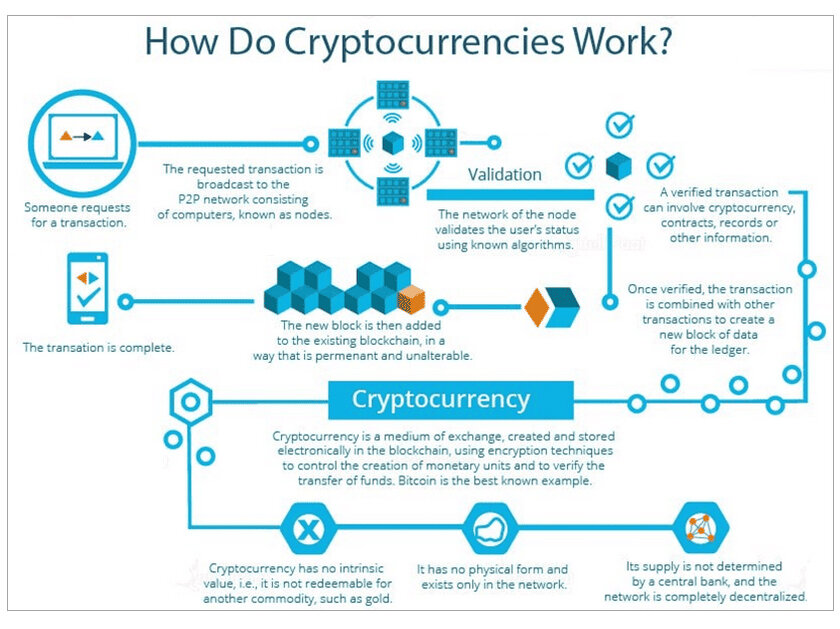

To understand this, let’s look at the base of what cryptocurrency actually is. Cryptocurrency is nothing but a popularly adopted use case of blockchain technology. Ghost-inventor Satoshi Nakamoto created this technology to create freedom allowing digital information to be distributed widely and unable to plagiarize. It is a new form of internet and is decentralized.

In 2011, he wrote, “The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.”

Yes, we can create cryptocurrency but to understand that we need to understand the concept of Block chain. Block chain is not the same as crypto currency. Bitcoin or cryptocurrency is the first widely known use of blockchain technology. Although blockchain technology is great for recording cryptocurrency transactions, it’s also widely used to track other assets, as well.

When businesses started to realize this, they began investing in blockchain as a solution for streamlining operations, breaking down data silos, improving transparency, and reducing transaction costs. Today, a wide variety of industries utilize blockchain technology to boost their bottom line.

There is healthcare, real-estate, voting, supply chain and myriad of other uses, however, Bitcoin still seems to have avoided the ‘Tulip mania’.

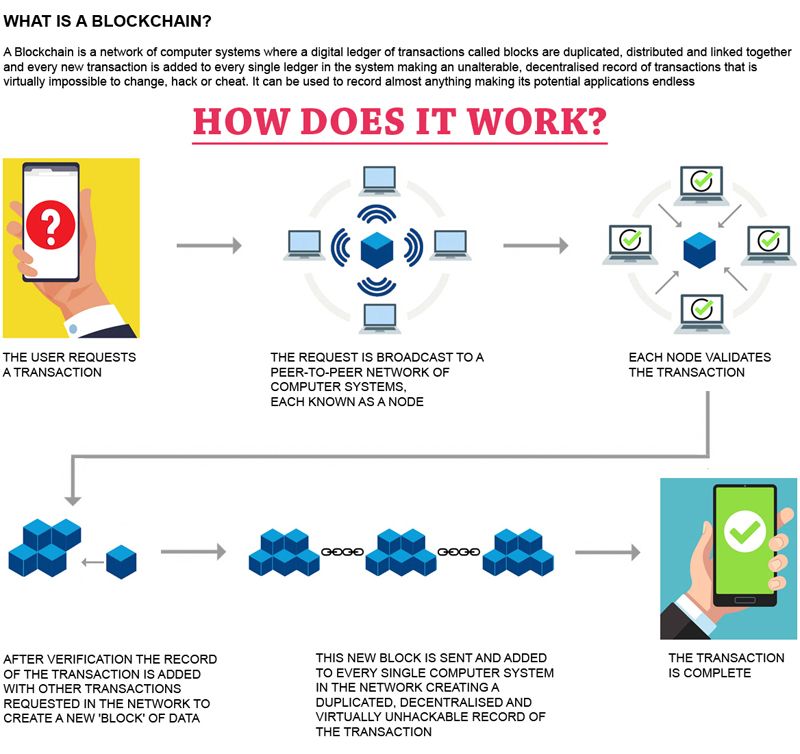

So what is a block chain?

Block in simple terms is a series of individual blocks of transactions done within a period of time. It would be difficult to identify the blocks without an identifier, so they have a unique identifier. To create a new block, ‘miners’ use the crypto currency network and specialized hardware called ASICs, to demystify the transactions and solve a cryptographic puzzle called the hash function, that enables adding new blocks and get rewarded with different cryptocurrencies like bitcoins or altcoins. Hashing data is one of the most secure data transfer practices because none of the original information can be accessed without a hash key.

Unique block identifier is called a hash and has information from the previous block in the block chain. So if someone has to falsify a block, they have to change every block in the blockchain. Earlier users required to add a new block to the blockchain and were rewarded with 50 BTC. As they are decentralized, instead of being stored in one central location, the blockchain is stored on the computers of every user of that given blockchain. Since blockchains are now public, it is even more difficult to falsify or duplicate. Block explorer allows anyone to view records in a given blockchain.

While public blockchains are the norm, private versions are also being explored as a solution for many business and government use cases.

Love it or hate it

I bought some bitcoins through an exchange, but I have always been fascinated to see how it is created, how it is valued, and this view by far is that as a layman I can make it without hiding behind cryptic technical terms.

What I found is that it is not straightforward. The man who created it simply disappeared to avoid the repercussions other people faced while creating non centralized monetary formats.

After curating and stabilizing the bitcoin project, Nakamoto disappeared for good in 2011. Today, the market cap on bitcoin blockchain is around $515 billion. So effectively there is a new form of currency that cannot be duplicated, which is 100% digital and not controlled by banks or governments and worth over half a trillion dollars.

Why do crypto currencies work?

Cryptocurrencies allow an outlet for personal wealth outside the restriction and confiscations paradigms of government and rules. Since they have exchange values different from conventional commodities, although like PayPal, they are not associated with the company. They are not valued on the basis of national and international standards.

‘The founders of the communities limit the number of tokens the computers underpinning the transactions in the community can generate. The crowdsourcing effort to fund the community is called an Initial Coin Offering (ICO). Nakamoto limited the number of Bitcoins generated by the distributed network of computers in his exchange to 21 million. This limitation in supply ensures demand for the tokens, which subsequently increase in value.’

Bitcoin Safety

While personal internet security remains paramount, individual fraud is what one needs to be on the lookout for. Cryptocurrency exchanges have occurred in the past with losses ranging to the tune of hundreds of millions (dollars). Since the market is limited it is a drop in the ocean compared to conventional banking losing billions of dollars.

Communities are working hard to identify and mend the vulnerabilities in their blockchain networks. Government central banks may get upstaged or be used to centralize and regulate bitcoins in the future, however, it does seem too complex at the moment.

Bitcoin and cryptocurrency is here to stay. Bitcoin is said as “Everything you don’t understand about money combined with everything you don’t understand about computers.”

In case you missed:

- None Found

2 Comments

While the concept of cryptocurrencies and blockchain tech embodies innovation, utilization, future web 4.0 (and beyond) vision and digital economic transformation, the current volatility within the crypto market presents main challenge for mass growth and faster adoption beyond 1 billion active global users. Even though the DeFi world & crypto universe disagrees with and dislikes the regulators and government agencies, we also have to realize it will be impossible for the crypto universe to remain under radar and at the same time be an active part of the global economic system. Add in crypto market cap of $1 Trillion + with ever-growing opportunities and potential and you realize how much purchasing power it has. That’s why the government agencies will come in – they will try to collect on taxes and VAT.

The only possible solution to coexist is crypto and blockchain friendly regulations that is created together with the community. Such laws and regulations should facilitate the blockchain tech growth and start-up development, which benefits everyone. That’s why EU is moving fast with MICA Act, which is not the best package of law, but it’s workable and it can help crypto projects future growth within the EU borders. Overall, such Crypto & Blockchain-friendly regulations do offer some useful protections for all and do enhance its growth opportunities, crypto should become less volatile and such economic & market stability should provide more potential for crypto’s wider future adoption by the population and within the global financial markets.

It’s a great observation. Thanks for your insight David.