Even as I write this article, Bitcoin has already made history by reaching a new all-time high of USD 106,000, breaking its previous high that it reached on December 5th, 2024.

Clearly, Bitcoin’s position in the fast-changing cryptocurrency world is being cemented like that of no other cryptocurrency. One of the factors being attributed to the crypto’s phenomenal surge to the USD 100K mark is the “Bitcoin Halving” event, which took place in April 2024.

Basically, Bitcoin Halving, which takes place once every four years, slashes the rate of creation of new coins, often boosting their price. As the Bitcoin cycle enters 2025, let us delve into what halving is and how it has an impact on this crypto’s future.

What is Bitcoin Halving?

Since the time of its inception, Bitcoin was designed to have a capped supply of 21 million tokens. Halving was written into Bitcoin’s code, working by reducing the speed at which new Bitcoin are released into circulation. However, the event does not reduce the number of Bitcoin in circulation; rather, the reward offered to miners for validating a block of transactions is reduced by half, a procedure called “halving.”

The Science Behind Bitcoin Halving

How exactly does it happen? Bitcoin was the first digital currency to be built upon Blockchain technology, which involves creating “blocks,” or records of information added to the blockchain, a process that is known as “mining.” So, it runs on a proof-of-work consensus mechanism where miners validating transactions are rewarded. Basically, miners compete to use computer algorithms to solve complex numerical puzzles, validating a new block on the Bitcoin network roughly every 10 minutes.

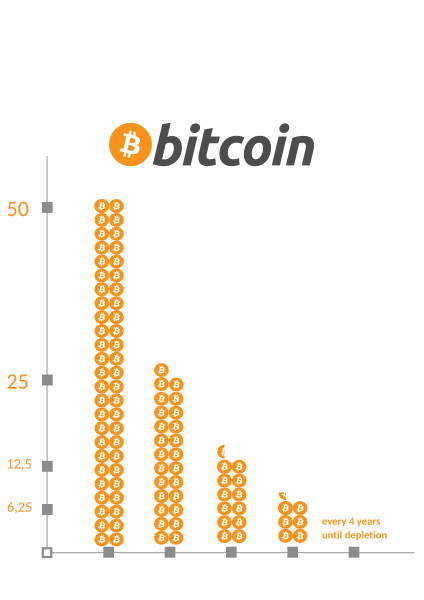

For this, the miners are rewarded with newly minted Bitcoin. However, the cryptocurrency’s blockchain is designed such that every time 210,000 blocks are added to it, a halving event occurs, which happens around every 4 years. So, when miners add every 210,000 blocks to the chain, they automatically receive only half the number of Bitcoin as a reward.

While this in-built proof-of-work and reward mechanism is critical for preventing fraudulent transactions and controlling inflation, it also works towards another key component of Bitcoin — its limited supply. As mentioned earlier, the maximum supply of Bitcoin has been fixed at 21 million, and roughly 19.5 million Bitcoin have already been mined. So, if we consider all upcoming “halvings” that will take place every 210,000 blocks (or roughly, 4 years), the last Bitcoin will be mined around the year 2140.

Thus, only 1.5 million Bitcoin will be created in the next 116 years, which means that inflation will be very marginal from a technical standpoint. Furthermore, halving also keeps the incentive of the miners alive for longer and delays the minting of the final Bitcoin, while contributing to the cryptocurrency’s anti-inflationary, fixed-supply ethos.

Market Dynamics: Is Halving a Good Thing?

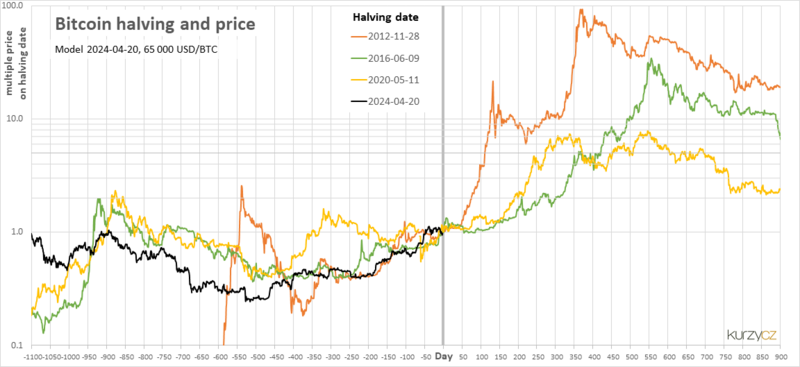

Historically, there have been four halving events, including the last one that took place on April 19th, 2024.

| Year | Mining Reward (BTC) |

| 2009 | 50 |

| 2012 | 25 |

| 2016 | 12.5 |

| 2020 | 6.25 |

| 2024 | 3.125 |

| 2028 | 1.56 |

| 2140 (approximately) | 0.00000001 |

Every reduction in rewards aims at maintaining the value and scarcity of Bitcoin, and historically, the lead-up to and aftermath of these events usually increases its market value. The increase is largely due to a slight decrease in supply, creating a shortfall of sorts if demand increases or even stays the same. Since the entire crypto ecosystem is closely connected to Bitcoin, the halvings tend to kickstart a new growth phase for the entire market.

So, where do the concerns lie? One is the mining process itself, with halving rewards impacting profitability due to unsustainable operational costs for miners. This could also potentially increase the chances of a 51% attack, where miners/a mining pool controls more than 50% of the network’s computing power or mining hash rate.

It could potentially lead to double-spending attacks and disruptions. However, the good thing to come from a halving event, and lesser mining rewards, is Bitcoin’s lesser energy consumption and environmental footprint, which has always been a point of concern and criticism.

Since the rewards are slashed by half, miners would want to lower energy costs by considering energy-efficient mining techniques to stay profitable. This trend, on paper at least, could possibly reduce the overall environmental impact by lowering the average energy consumption per transaction.

Interestingly, after the most recent halving, the phenomenal price surge did not happen. There could be multiple reasons for the same, including higher interest rates and inflation putting a strain on investors’ budgets. So, it could be possible that investors pursued less volatile investments. Another reason could be the upcoming U.S. elections at the time. So, while historical trends do offer helpful context, they rarely repeat verbatim and there are no guarantees. So, evident from Bitcoin’s current price.

Ever since Bitcoin surpassed the USD 100,000 mark, the question on everyone’s minds has been: could Bitcoin hit the USD 1 million mark? The ask is ambitious, but the crypto’s price could certainly climb higher, what with it breaking its own price records in less than 15 days as 2024 ends.

In case you missed:

- Everything you need to know about Pi Network

- The Pi Network: IOUs, Coins, And The Network’s Future

- IoT and its role in energy transition

- Password Practices For A Safe Digital Presence

- Green Data Centres: Future-ready for Sustainable Digital Transformation

- Re-examining Cybersecurity through Blockchain

- Top Digital Transformation Trends For 2024

- The Life of Pi Network – FAQs and Everything Else You Want To Know

- Technology for good – How IoT is driving sustainability

- How Blockchain Can Solve AI’s Trust Problem