Uma Iyer traces the developments of the stock market, and explores the role of and future potential for technology in share trading.

Back in the day, the share market used to be depicted by a big bull outside Wall Street in New York, busy shouting at individuals buying and selling stocks. High voltage voices echoed through NASDAQ and other high trading places. The bell used to be rung to start a trading day and stop the trading day! Brokers and traders made money speculating by reading through scores of papers and annual reports, predicting the future of a stock or share. Someone once told me, for Reliance companies which has the name Dhirubhai Ambani, you need not see the balance sheet once! Such was the pedigree and belief people worked with.

Moving to 2020, when COVID hit, Trading 212 was an online system that I got onto. It gave me free money to learn investment, it had a wizard based mechanism to take me through stocks and the trends and allowed me to invest up to 200 pounds. While it was interesting, what I really could not find was one place where I could actually predict what the stock would do in the next few months, for example, pharma companies especially given the need for vaccines. I forgot about the application until 2 months after, when a friend of mine was trying to get a login created, but the application had maxed out its capacity. People were on waitlist to get on to the tool as they were home and it was the next best thing to do and learn and invest. It’s the privacy of learning and the ability to fail and learn at one’s own pace and being discreet sans human intervention that makes the premise very appealing.

Stock market evolution

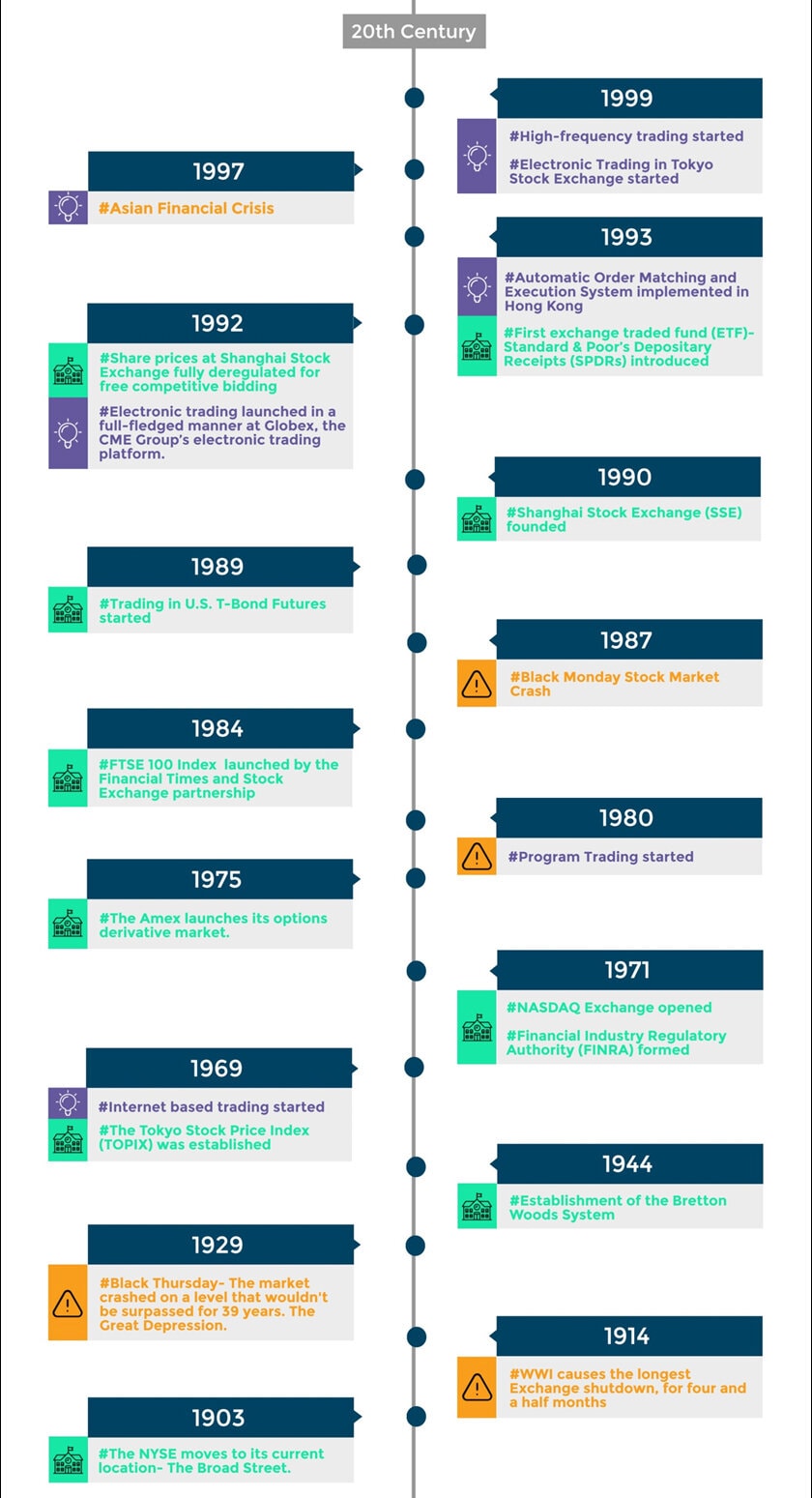

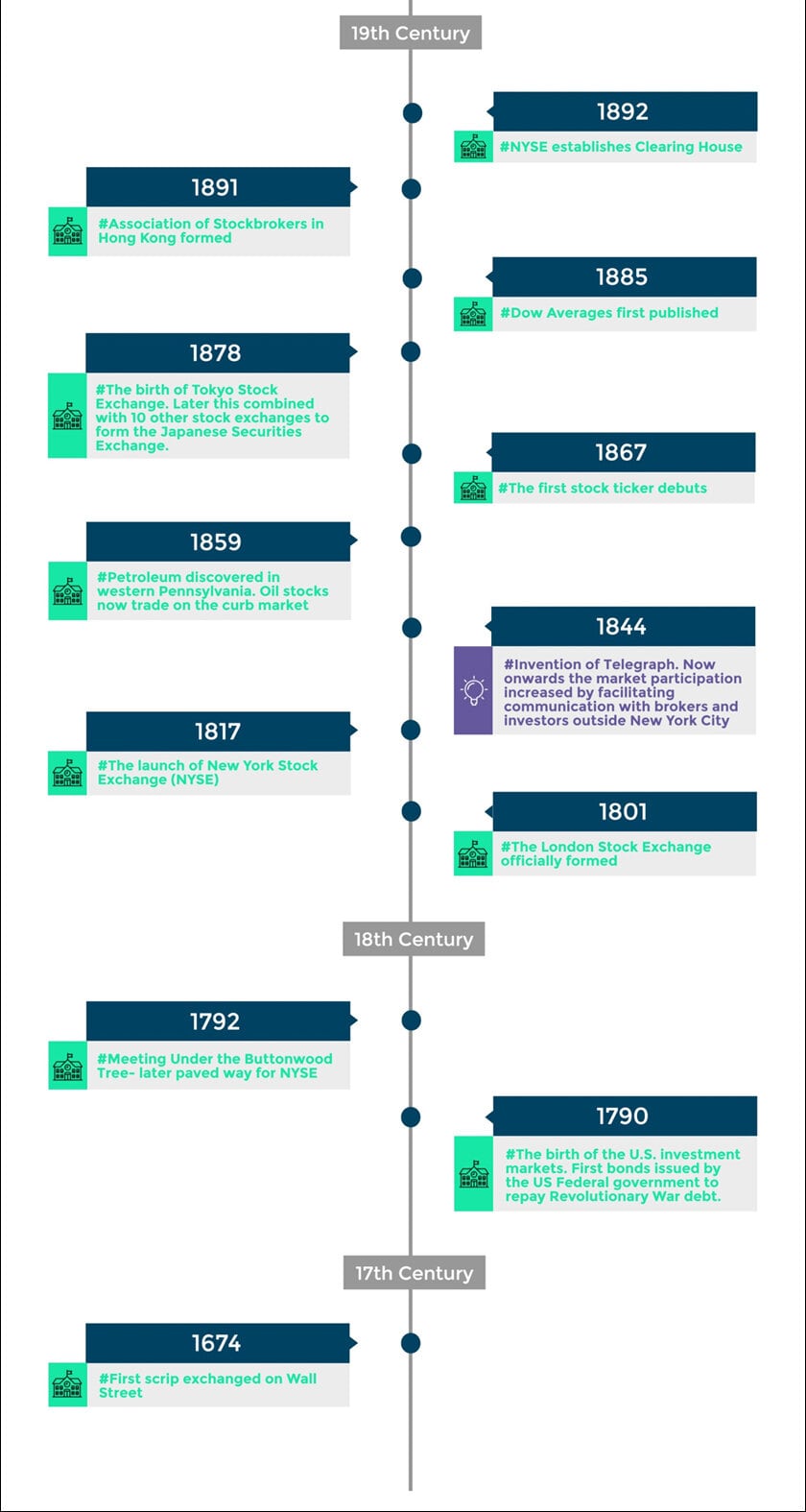

While the history of the stock market dates back to the 13th century in Europe. International trade worked on the premises of procuring and retaining goods in view of potential rising prices. The Dutch East India company was the first publicly traded company in 1611. A group of merchants met daily to buy and sell stocks and bongs.

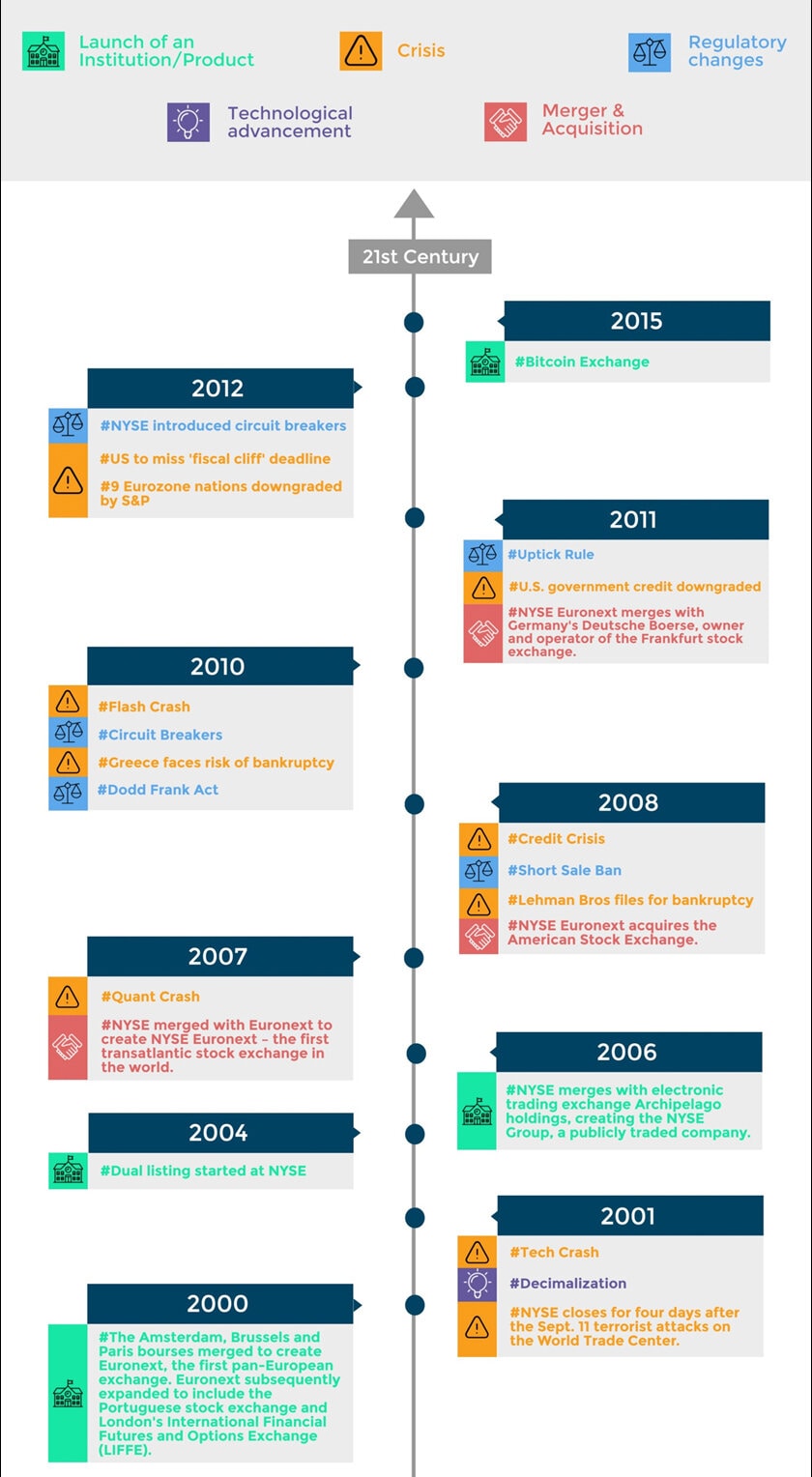

In 1674, the first scrip was exchanged in Wall Street, which eventually led the US federal government to issue bonds to repay the War debt. The New York Stock Exchange was started around the 18th century, followed by the London Stock Exchange, followed by the finding of Oil and oil stocks, eventually followed by the Tokyo Stock Exchange in the 19th century and clearing houses were created. After tiding the Great Depression in the 1900s, Financial authority was formed while the internet trading began taking pace in 1969. After the Shanghai Stock exchange was founded in the 1990s, electronic trading was launched using CME groups electronic trading platform. The Shanghai stock exchange introduced an automatic order matching and execution system followed by high frequency trading. In 2000 Europe caught pace and bourses merged to create Euronext leading to furthering transatlantic mergers with NYSE.

The pace of development combined with technology has been so fast paced, that many initiatives like circuit breakers, rules have been introduced to ensure that the market does not crash the way it has been! What started in the Middle Ages by merchants requiring a specific price arrangement for fair trading transactions, evolved to wealthy merchants selling bonds in return for high interest loans making further money and pay interest to people buying them. All of this process with a variety of products can now be done at the touch of a button.

Volumes and development

The advent of new products and the volumes being traded, globally there is appetite to build technologies to satiate the demand. The information flow, introduction of bitcoin and other mechanisms and faster clearances means people want to have access to information at fingertips and redundant information and scouring needing to be managed by machines.

When one opens an account with any of the online mechanisms you can trade and commission may or may not be charged on the trading.

Computer based trading

Rule based trading with a set of rules made for investment, e.g. the right time to invest, not investing on the same day as the stocks are published, doing a 3 day average calculation, etc was traditionally used while buying stocks and share. This has now evolved to create an algorithm based approach where computers trade independently when criteria values and vectors are met. It is not a binary decision anymore. There are options to carry on automated stop-loss orders. The numbers of trades can be done in a limitless fashion and also use high-frequency trading to exploit and manipulate prices.

While historical data proves very valuable in this instance, there is analytical feature based SHAPS data that can be used to make learning models very effective and stop investments where there is no benefit.

We can tell a machine to do a specific activity when a certain occurrence happens, but AI takes it a way further by determining which specific activity to look out for and what occurrence needs to happen.

Some of the key tools that are used in the market are fintech app, Front, MetaTrader 5, TradingView, Trading212, etc.

AI, is it the future?

Cheap and easy methods for finding investment mechanisms using applications and not having to deal with pushy traders and brokers and experimenting from your bedroom privacy losing a few pounds or rupees in the process without the shame of failure is one of the biggest benefits.

Manipulation of the market, especially when it’s purposeful, can be catastrophic, where malicious traders can use automated algorithms to sway markets to their advantage. Additionally, human intuition is very difficult to replicate and sentiment analysis and opinions weightage cannot be manipulated in real-time, AI systems are far from making intuitive decisions.

One of the biggest benefits is the ability to detect and flag fraud based on key data points. NASDAQ has adopted an AI powered anti-fraud system as of 2019 where malicious activities can be detected and pitfalls can be avoided. While revolutionary, apart from aiding the investors, it can be a powerful tool for regulators as well.

It is too early to declare it as a shapeshifter on the basis of the same. AI is effectively able to predict information based on the available vector, however, the human emotion that affects the share market is very difficult to train and exploit. While mistakes and human errors can be avoided and stop gaps can be set including evaluating huge amounts of data, everything is predominantly dependent on the ‘data’ that the application is fed with. AI is only as good as the data and self cleaning and cleansing capability is still evolving.

In case you missed:

- None Found